Blackrock CEO Retirement Age: Retirement has long been considered a milestone, a golden era marking the end of one’s professional journey and the beginning of a life of leisure. However, as societal norms evolve and life expectancies increase, the concept of retirement undergoes scrutiny.

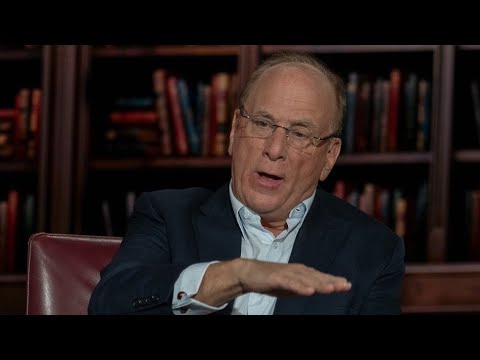

Recently, Larry Fink, the CEO of Blackrock, a prominent asset management firm, sparked a conversation by questioning the adequacy of the traditional retirement age.

Blackrock CEO Retirement Age

In a bold statement, Fink expressed his discontent with the conventional retirement age of 65. He remarked, “No one should have to work longer than they want to. But I do think it’s a bit crazy that our anchor idea for the right retirement age — 65 years old — originates from the time of the Ottoman Empire.”

At 71 years old, Fink’s perspective carries weight, especially given his position in the financial world.

Fink’s sentiments, expressed in an annual letter to investors, reflect a growing sentiment among individuals who question the relevance of a retirement age established centuries ago. As life expectancy has increased significantly since then, many argue that the retirement age should adapt to reflect this demographic shift.

Blackrock CEO Larry Fink Says 65 Retirement Age Is Too Low, Know Experts’s Opinion

Fink’s critique prompts reflection not only on the adequacy of the retirement age but also on potential reforms to retirement systems. Experts in the field of finance and retirement planning offer diverse perspectives on this matter.

According to experts cited in CNBC, the traditional retirement age of 65 may no longer align with demographic realities. With more Americans reaching this age than ever before, the idea of 65 as the standard retirement age is increasingly outdated.

Consequently, some propose revisiting retirement policies and considering alternative solutions to address the evolving needs of an aging population.

As life expectancy continues to rise and individuals lead healthier, more active lifestyles in their later years, the concept of retirement transforms. Instead of viewing retirement as a static endpoint, experts advocate for a more flexible approach that accommodates individual preferences and circumstances.

Challenges and Solutions

The discussion surrounding retirement age intersects with broader societal challenges, including the sustainability of retirement systems and financial security for aging populations. With the strain on social security systems and pension funds, policymakers face the daunting task of ensuring the long-term viability of retirement programs.

CBS News reports on the ongoing debate over the future of retirement, highlighting the urgency of addressing the financial implications of an aging population. While some advocate for raising the Social Security retirement age as a solution to mitigate fiscal pressures, experts caution that such measures may not be sufficient.

Instead of solely focusing on increasing the retirement age, experts emphasize the importance of implementing comprehensive reforms that address systemic issues. This may include initiatives to promote retirement savings, enhance access to healthcare, and support older workers in transitioning to retirement.

As discussions surrounding retirement age gain momentum, it is evident that a one-size-fits-all approach no longer suffices. The needs and aspirations of individuals vary widely, necessitating a more nuanced understanding of retirement planning.

In reimagining retirement for the 21st century, stakeholders must collaborate to develop innovative solutions that ensure financial security and well-being for aging populations. By embracing flexibility, adaptability, and inclusivity, we can pave the way for a more sustainable and fulfilling retirement landscape.

Larry Fink’s critique of the traditional retirement age catalyzes broader conversations about the future of retirement. While challenges abound, opportunities for positive change abound as well. By embracing innovation and embracing diverse perspectives, we can shape a retirement paradigm that meets the needs of today’s society.