Steve Cohen’s ownership of Bitcoin, influenced by his son’s advice, marks a significant development in the intersection of traditional finance and cryptocurrencies. As a billionaire with extensive experience in financial markets, Cohen’s endorsement of Bitcoin carries weight and could signal broader acceptance of digital assets among institutional investors.

While Cohen’s investment in Bitcoin may be relatively modest compared to his overall wealth, it underscores the growing relevance of cryptocurrencies in investment portfolios. As the cryptocurrency market continues to evolve, Cohen’s decision may pave the way for greater institutional adoption, further legitimizing digital assets as a viable investment option.

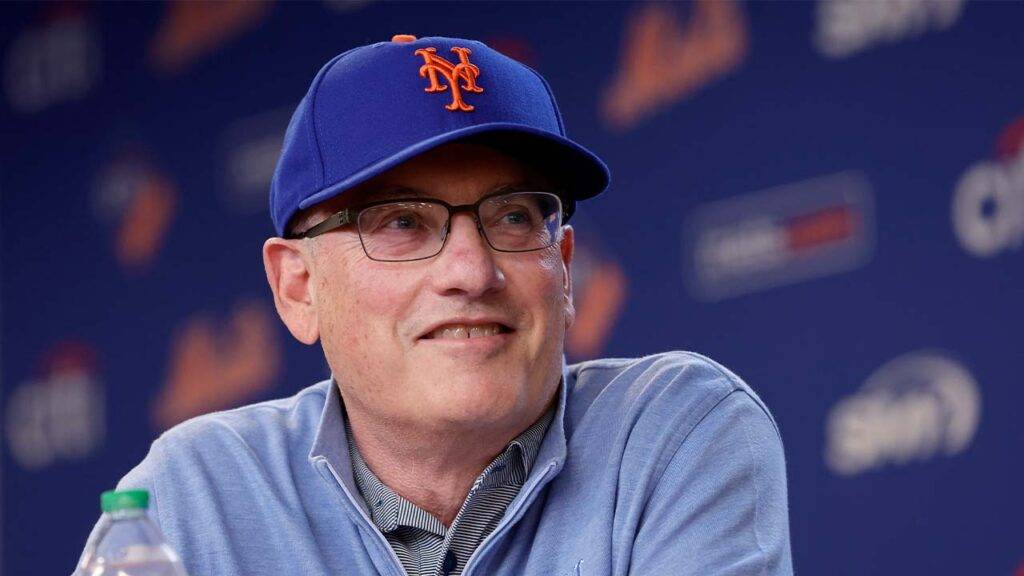

Who Is Steve Cohen?

Steve Cohen, a prominent figure in both the financial and sports worlds, is the chairman, CEO, and president of Point72, a renowned hedge fund. He’s also recognized as the owner, chairman, and CEO of the New York Mets baseball team. Cohen’s influence extends across various sectors, from finance to sports, making him a notable figure in the business landscape.

Billionaire Steve Cohen Says He Owns Bitcoin Because of His Son

According to Foresight News, Steve Cohen, a prominent hedge fund magnate, has disclosed that he owns a small amount of Bitcoin. This decision was reportedly influenced by his son’s advice. As per the Forbes 2023 list of the top 100 richest Americans, Cohen ranks 37th with a wealth of $19.8 billion.

Cohen’s acknowledgment of owning Bitcoin sheds light on the growing acceptance of cryptocurrencies among traditional investors. Bitcoin, the pioneering cryptocurrency, has garnered significant attention and investment from various quarters in recent years.

Cohen’s decision to enter this space, albeit in a limited capacity, underscores the evolving investment landscape and the increasing relevance of digital assets.

Steve Cohen’s Perspective on Bitcoin Ownership

In an interview with CNBC, Cohen shared insights into his ownership of Bitcoin and the factors that led to this decision. While Cohen is renowned for his expertise in traditional financial markets, his foray into cryptocurrency investment signifies a broader acceptance of digital assets within the mainstream financial community.

Cohen’s revelation that his son played a role in his decision to own Bitcoin highlights the generational shift in investment attitudes.

Younger generations, often more tech-savvy and open to innovation, are increasingly advocating for the adoption of cryptocurrencies as part of investment portfolios. Cohen’s acknowledgment of his son’s influence underscores the importance of intergenerational dialogue in shaping investment strategies.

Implications for the Cryptocurrency Market

Cohen’s entry into the cryptocurrency market could have broader implications for the industry. As a prominent figure with significant influence in traditional finance, his endorsement of Bitcoin may lend credibility to digital assets, potentially attracting more institutional investors.

Moreover, Cohen’s decision to invest in Bitcoin could encourage other high-net-worth individuals and institutional investors to explore cryptocurrencies as an alternative asset class. This influx of capital could contribute to the maturation and stabilization of the cryptocurrency market, further cementing its place in the global financial landscape.